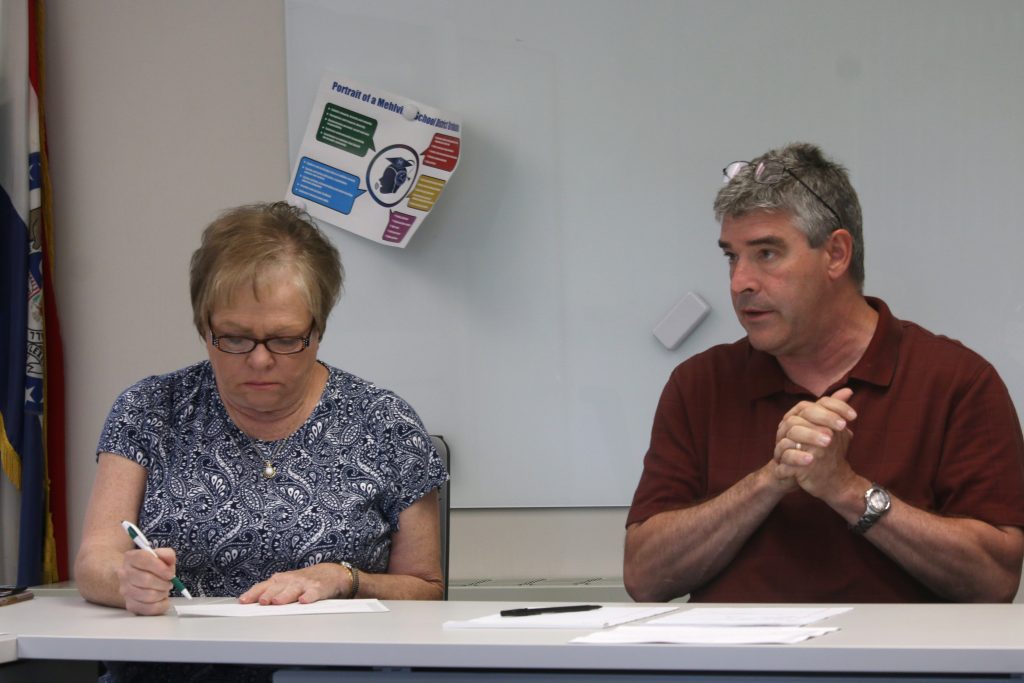

The Mehlville Board of Education unanimously voted to roll back the district’s blended tax rate 35 cents during its annual tax-rate hearing Sept. 24, ahead of tax bills due Dec. 31.

Chief Financial Officer Marshall Crutcher said assessed values increased 12.4 percent this year, a decrease from St. Louis County’s preliminary assessment of 15 percent.

The board approved the 2019 blended tax rate of $3.7994 per $100 of assessed value, an 8.4-percent decrease from 2018, to offset this year’s increases in assessed property value.

There were no members of the public who spoke at the tax-rate hearing.

The blended tax rate, which is not levied, is the average rate of residential, commercial, agricultural and personal property taxes. The blended rate includes the 4-cent temporary tax for Proposition A, passed by voters in 2016, which will sunset in 2025.

The tax rates for 2019-2020 by category are as follows:

• Residential tax rate: $3.6537

• Commercial tax rate: $3.8328

• Agricultural tax rate: $4.3698

• Personal property tax rate: $4.5374

Crutcher said that the tax rate went down because the assessed values of properties increased significantly more than inflation and the Hancock Amendment places limits on how much financial windfall government agencies can receive from increased assessments. The CPI increased 1.9 percent.

“The Hancock Amendment limits tax revenues to increase only up to inflation, or the consumer price index,” Crutcher said. “The additional increase of assessed values result in decreased tax rates, so the tax revenue does not increase more than inflation.”

Overall, the district’s tax revenue will increase about $2.2 million to $75.6 million, $375,000 more than budgeted.

New construction totaled $6.8 million compared to $12.4 million last year and accounts for about $252,000 of the total tax levy.