Editor’s Note: The Dec. 18 print edition of The Call incorrectly published that the number of parcels was instead a dollar amount per parcel due to a misinterpretation of the county report. It has been amended online to include the number of parcels that contribute to lost revenue per school district.

After a long and arduous process, the first year of St. Louis County’s senior property tax freeze has come to fruition — seniors across the county received their tax bills in the past month and tallied up the money saved. Meanwhile, local school districts have lost thousands of dollars in revenue, which they would normally accrue through senior property taxes.

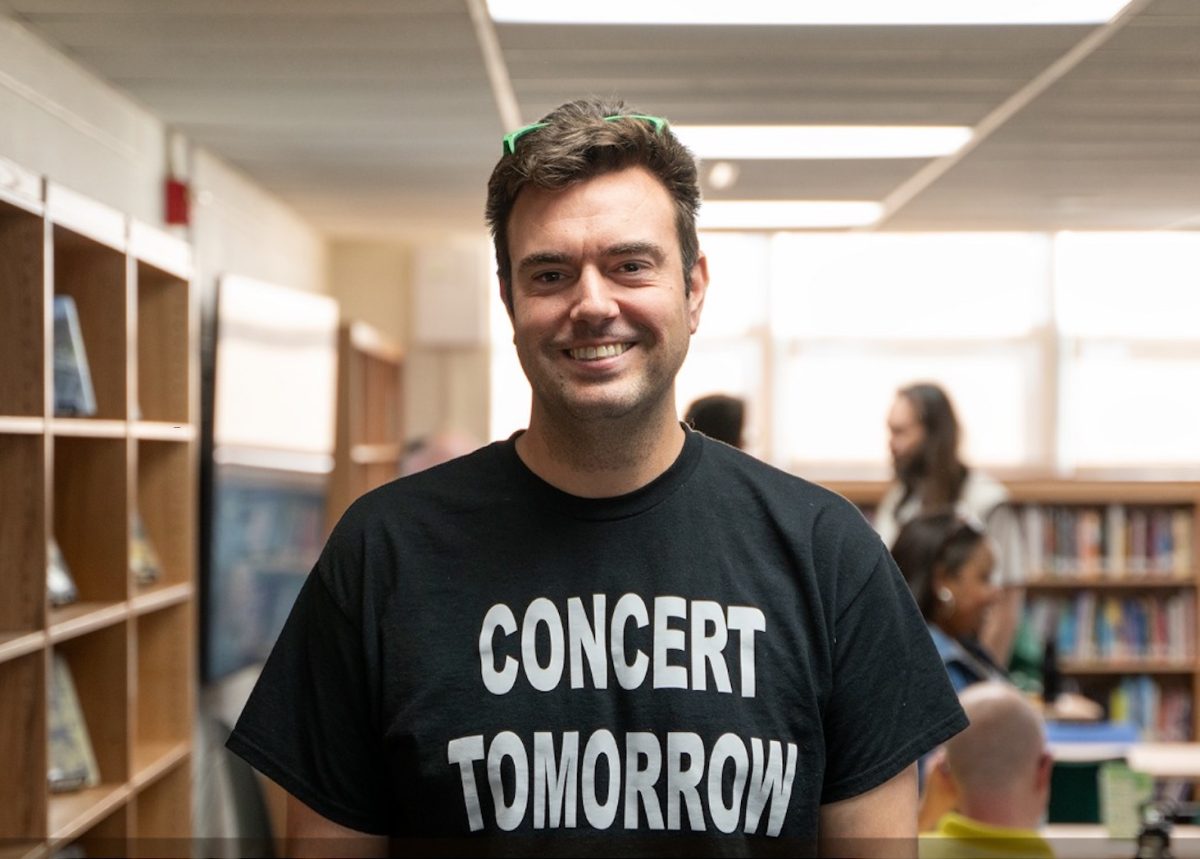

“We understand that there are people in the community who need that (tax) relief,” Lindbergh Schools Superintendent Tony Lake said. “We also understand the community’s desire to have amazing public schools. Finding that balance is really important.”

Some school districts in the South County area were prepared for the revenue loss, while the county’s estimates took other districts — and their budgets — by surprise. Across the board, South County schools won’t see any cuts to staffing or programs, but as the senior tax freeze remains in effect, the future is uncertain.

Property taxes aren’t due until the end of the year, so St. Louis County’s projections are not final, but local districts expect the estimates to be accurate.

Lindbergh Schools is facing a whopping $1,344,092.53 in lost revenue from 4,537 parcels. These numbers came as a shock when they were released in November. According to Lake, he was told at a meeting with the county in spring 2024 that the district could expect a projected revenue loss of about $500,000, or $5 million over the course of 10 years. The revenue lost from Lindbergh’s $105 million operating budget was more than doubled.

The county offered no updated projections until the tax bills were already in, so Lindbergh’s budget had been built around the $500,000 projection. The additional $800,000 or so was a blindside for the district.

According to Lake, Lindbergh is not being forced into any major adjustments at the moment. The most immediate effect is the upcoming raise negotiations that will circulate in the district come next spring. Lindbergh typically negotiates a two-year agreement for a 3% raise — a 3% raise is already “locked in” for next year — but that may be impacted if the district continues to lose revenue. Lindbergh may consider negotiating a one-year raise agreement with faculty if losses are still fluctuating.

For now, any changes are conversations for the future. This year should progress without much change from the norm. However, Lake says that, if revenues continue to shrink, “the only way to address that shrinking is through reduction of staff and programs.” 86% of Lindbergh’s expenses are from people and programs.

“We’re not pushing the panic button yet, but we continue to have conversations from Jefferson City around eliminating income tax, getting away with personal property tax,” Lake said. “These revenue streams that schools, fire and police have to give basic services to our community, if they begin to shrink, those services may start to look really different.”

Lake doesn’t know what the next few years will look like for the senior tax freeze and its impact on the district. For now, he strives to keep clear lines of communication open with the community as the district grapples with a potentially fluctuating budget.

“Next year will be a really telling year,” Lake said. “There may be some people who didn’t realize they could do it or just missed that opportunity. In the next year or two, we’ll really know if this first year — that $1.3 million — is what we can count on moving forward. It’s hard to tell. We’re hoping we’ll know, to be able to budget, but until we’ve run through two or three years of this, we won’t know the exact impact on the budget.”

The Bayless School District will face $57,401.77 in lost revenue from 739 parcels. According to Stephen Terrill, Bayless’s marketing and communications coordinator, the district did not receive prior projections from the county. Their own internal projections matched the revenue losses they are seeing now, so their budget, programs and staff will not currently be disrupted.

“We’re efficient with our money, but our budget does remain tight due to our low assessed valuation and our low tax rate,” Terrill said. “That number coming out of property tax does hurt us a little bit, but we’ll continue to be efficient, to fund our staff and opportunities for the kids at Bayless.

Terrill says the district is keeping an eye on the “financial headwinds” in the state as they move forward, but he does not expect any major cuts within the district at this time.

The Affton School District will face $199,611.49 in lost revenue from 1,909 parcels. Affton Superintendent Travis Bracht says the district has been theorizing for over a year what the impact of the senior tax freeze will be on the district. The finance department’s prior calculations for this year’s budget were in the $165,000 range, so Affton lost a bit more revenue than expected.

Bracht said at a Dec. 2 Board of Education meeting that this loss is not enough of a discrepancy to scramble, revise the budget or cut programs, but he and the board are paying attention to what the future may hold.

“We finally have a number,” Bracht said at the meeting. “Going forward, we can use that number to make up our budgets with that reduced revenue in mind.”

The Mehlville School District will take one of the biggest hits in South County, with $864,765.39 in lost revenue from 8,952 parcels — the most parcels of any of the five school districts. According to Mehlville’s chief communications officer, Jessica Pupillo, the district had no surprises: it was prepared for that number and was able to budget accordingly.

“Our projected revenue for our current budget year accounted for the senior property tax freeze — we budgeted for a drop in revenue of $1 million,” Pupillo said. “We do not anticipate changes to programs or services.”

The Hancock Place School District will face $28,849.24 in lost revenue from 273 parcels. The district budgeted less than usual for this fiscal year, anticipating a dip in the revenue from property taxes, and will continue with programs and services as usual.

“We continue to monitor the impact of annual changes in revenue or in our expenditures on an ongoing basis,” Carl said. “In this situation, we had already set our budget before knowing the impact of the program. It is challenging to set a budget when revenues are fluctuating and uncertain. If there are funding changes from the legislature or expansion of the senior property tax program, in the future, it would be necessary to analyze the impact and make any necessary adjustments.”

The senior tax program by St. Louis County freezes certain real property taxes, excluding personal property, and no tax bill was completely frozen, according to the county’s website. Qualified seniors did not have to pay the increase in the actual tax amount of general operating taxes, which is dependent on individual assessments of their property and any changes to the tax rate where they live.

To learn more about the senior tax freeze or the tax rates for South County school districts, check out The Call’s previous reporting. Keep an eye out for future reporting about how local municipalities and fire districts are responding to lost revenue from the senior tax freeze.