The Crestwood Board of Aldermen will hold a public hearing Tuesday, Sept. 22 to set the city’s 2020 tax rate at 60 cents per $100 of assessed valuation for residential property and 82.1 cents per $100 of assessed valuation for commercial property.

The Board of Aldermen will meet virtually at 7 pm. Tuesday, Sept. 22. Members of the public will be able to speak during the videoconferenced hearing on the tax rate.

Crestwood’s proposed tax rates per $100 of assessed valuation for 2020 are 60 cents for residential property, 82.5 cents for commercial property and 74.3 cents for personal property.

Last year, rates were set at 59.8 cents for residential property and 82.1 cents for commercial property, while personal property was the same at 74.3 cents.

Setting the tax is an exercise that has to occur every year to turn in the proposed property tax rates to the county by the beginning of October.

Crestwood has a 2020 assessed valuation of $223.39 million in residential property, $68.13 million in commercial property and $35.14 million in personal property. The city does not have any agricultural property. Combined, the city’s assessed valuation is $326.66 million. Last year, Crestwood’s assessed valuation was $332.15 million.

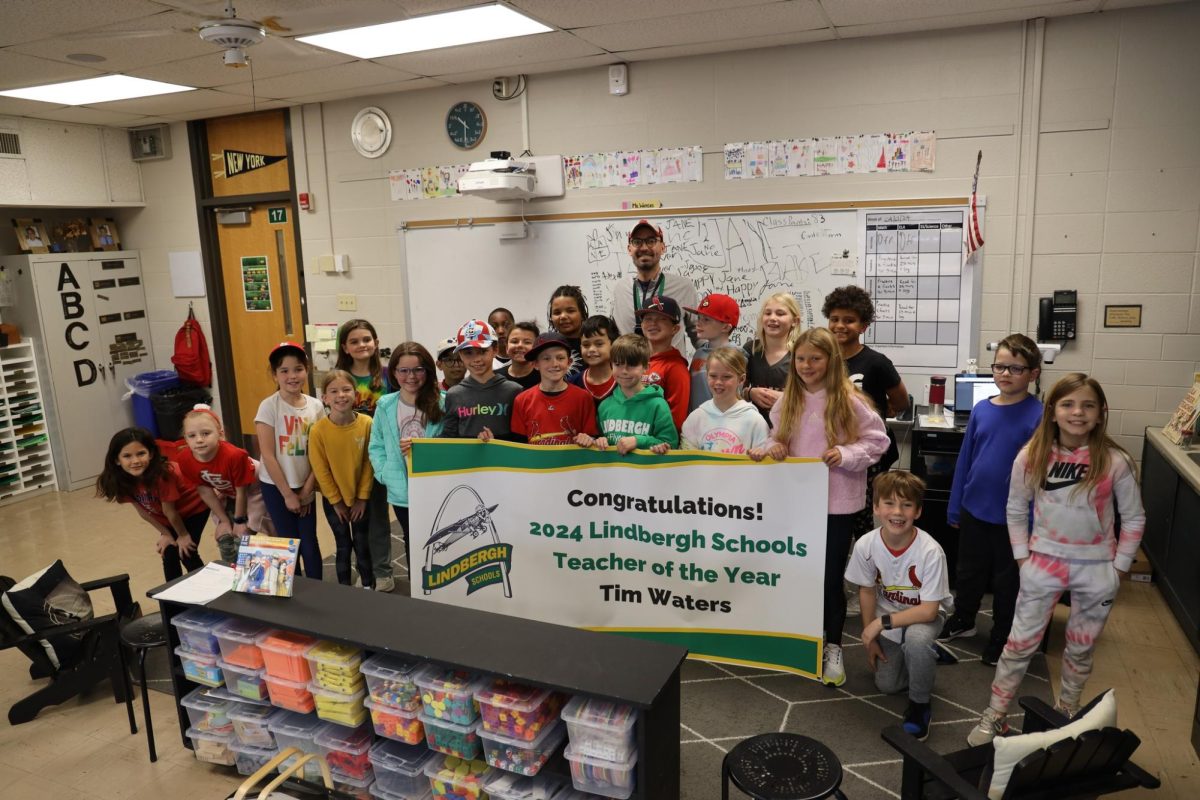

Crestwood’s school district Lindbergh Schools will also set its tax rate at a hearing Tuesday, Sept. 22.

Neighboring South County municipality Sunset Hills set its tax rate at its meeting earlier in September. The city adopted tax rates per $100 of assessed valuation for 2020 at 47 cents for residential property, 52 cents for agricultural property, 48 cents for commercial property and 60 cents for personal property.

The Mehlville School District will hold a public hearing to set its tax rate Monday, Sept. 28.

Editor’s note: This article has been updated with the correct tax rates.