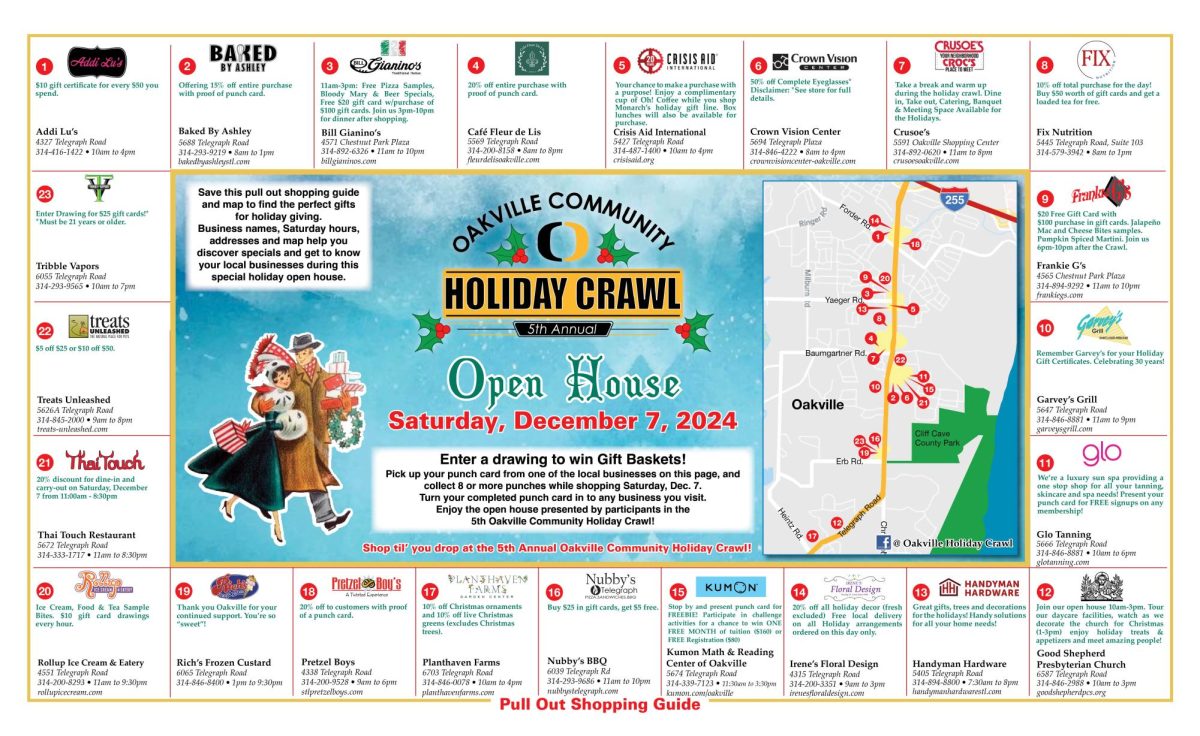

A long-coveted grocery store may soon be coming to the vacant Toys “R” Us in Sunset Hills after the Board of Aldermen got its first glimpse of the proposal earlier this month, including a request for a 40-year sales tax.

The name of the grocery store that wants to locate in Sunset Hills has not been publicly revealed. Building owner Sansone Group and a consulting firm presented a petition in a public hearing March 9 that would establish the Shoppes at Sunset Hills Community Improvement District, a sales tax, to fund the store at the former Toys “R” Us, 3600 S. Lindbergh Blvd.

The CID would impose a 1-percent sales tax at the location, which includes the Toys “R” Us space that shuttered in 2018 and the now-vacant Ross Dress for Less, which closed earlier this year.

Following an hourlong discussion during the March 9 first reading of the bill, a second reading on the ordinance to establish the CID was set Tuesday, March 23 — after The Call went to press. City officials rejected tax incentives, including a CID, last year that would have funded a parking garage and improvements next door at Helen Fitzgerald’s and the new Comfort Suites.

The Shoppes at Sunset Hills shopping center was built in 1997 and consists of two components: The 92,074-square-foot building that currently houses The Tile Shop and the vacant Toys “R” Us and Ross, as well as a 5,500-square-foot outparcel with LongHorn Steakhouse. The main building is 81-percent empty.

Sansone’s representatives declined to reveal the anchor user, although it would be a grocery store that is “brand new to the market.”

“This is a chance to take a very troubled center and put a high volume, you know, attractive tenant to the center and really give it a great shot in the arm to sort of, kind of, save the property … to cure the blight,” said Doug Rasmussen of St. Louis consulting firm Steadfast City Economic & Community Partners, which conducted a “blight study.”

After visiting the site twice in February, “we … did under the CID Act, find that the property is blighted,” Rasmussen said.

The three primary findings of the blight study highlighted poor and inadequate vehicular access and an outmoded retail space as well as cracked parking lots, broken curbing and a deteriorating building.

The center is one way in/one way out off South Lindbergh Boulevard, and the ramp off Watson Road onto Lindbergh requires a quick change of lanes to get to the left lane to access the center.

“Poor and inadequate vehicular access … creates safety hazards and challenges for the center,” said Rasmussen. “Our research actually found that there were seven vehicular accidents involving damage and injuries over the last calendar year from February of 2020 to February of 2021.”

Under Missouri’s CID Act, blight also extends to outdated spaces. Retail brick-and-mortar stores have seen a steady decline over the years for in-person sales, which was only accelerated by the COVID-19 pandemic as more and more people conduct their shopping online.

“With COVID and even before COVID, there’s been lots of changes in retail and retailing and this center, I think, has fallen victim to some of the trends that go with e-commerce and some of the story of accelerating trends with COVID,” said Rasmussen. “In particular, with more and more online shopping and coming to the store for curbside pick-up, going to the store to pick up an item and then leave the store and not fully shopping the entire showplace … because of that, you got retailers nationwide that are reducing the size of the boxes sometimes up to 30 percent.”

In three years, the Toys “R” Us has not had any offers until the grocery store proposal. Although the Ross Dress for Less just closed this year, the center has been marketed at 80-percent vacancies for the past three years because of a co-tenancy agreement.

“When Toys ‘R’ Us went out, there’s a co-tenancy requirement and because of that we also knew that Ross would likely be leaving, they had an outlet (from the lease) … and they’ve been marketing the property really as an 80-percent vacant center for about three years and have had no offers on the property whatsoever before the proposal,” said Rasmussen. “This center has had a flat or decreasing assessed value since 2018, and you can go right in that same neighborhood in the same time period and see other centers are increasing in value and producing more taxes.”

The actual redevelopment proposal itself would call for utilizing the CID Act to redevelop the anchor building for new tenants by repurposing the former Toys “R” Us space into a 37,000-square-foot space for an anchor user that would occupy the space by 2022. The developer would seek to reimburse about $5.4 million of CID-eligible costs through a 1-percent sales tax collected at the property for up to a 40-year period. Most CIDs last 20 to 25 years.

The anchor tenant would generate a projected $30 million in revenue, which would lead to $450,000 in new sales taxes for the city during the anchor tenant’s first year of operation.

Ward 2 Alderman Casey Wong questioned the reasoning behind a 40-year CID rather than the standard 25 years.

“The cost associated with the project, the eligible costs, are well in excess of the projected CID revenues. Even with the projected CID revenues, 40 years — the rate of return on the project is well below what would be expected,” said attorney Mark Grimm with GilmoreBell, legal counsel for the city on the project. “The developer is seeking to get some revenues from this site as opposed to what is being generated now, which is very low. Even with a 40-year term, the rate of return is significantly below market. … Forty we thought was reasonable.”

Part of the redevelopment would also include a cross-access agreement with the Helen Fitzgerald’s/Comfort Suites property next door. Cross access would be a CID-eligible expense.

“There will be cross access from Helen Fitzgerald’s so people exiting the new hotel, the Comfort Suites and Helen Fitzgerald complex could have access into the parking lot and exit to the light,” said Mayor Pat Fribis.

Cross access is something city officials have long asked for from Sansone and the properties next door.

Ward 3 Alderman Cathy Friedmann questioned the length of the possible lease, although the representatives said that they could not disclose that due to confidentiality reasons.

“We know we’re looking at 40-year CID and you’re projecting revenues off of this business for 40 years but we don’t have a lease that long, or you can’t tell us there’s a lease that long,” questioned Friedmann. “Is the length of the lease something the Board of Aldermen can object to in its sole discretion … ?”

Aldermen could object to the lease, City Attorney Robert E. Jones said. A typical retail lease is between 10 and 15 years, with multi-year extension options.

“This is a great opportunity for our city and we want to give them a bit of wiggle room. They presented blighting very professionally and very accurately and the CID,” said Fribis. “This is our opportunity to ask questions but we don’t want to make it so hard on them, on the Sansone Group, and hamstring them that it falls through. That’s my personal opinion.”

Ward 1 Alderman Ann McMunn asked if the developer might seek further tax incentives down the road, such as an abatement or tax-increment financing.

“There could always be an application, but we can’t predict the future,” said Fribis.

“Can we put a condition in the ordinance that further tax incentives will not be granted?” asked Friedmann.

Jones said that adding a condition like that into the ordinance would be binding to future boards, which is not possible.

“You can’t do that because they would always have the opportunity to come forward to another board,” said Jones. “Throughout the negotiations in the last three or four weeks, we’ve looked at every possible financial scenario and the Community Improvement District is what they need. There was no desire to create another district.”