The Mehlville School District could be receiving more money from its Proposition S bond issue than it had originally bargained for due to lower interest rates, giving the district a chancse to address even more facility needs.

Proposition S was a 12-cent, $35 million bond issue that was overwhelmingly approved by voters in the district with 80.1 percent of the vote in the municipal election earlier this month. The bond issue will use part of the funds left from paying off the lease approved by 2000’s Proposition P for facilities to fund secure vestibule entrances at all 18 of Mehlville’s schools, along with basic maintenance and accessibility at all schools.

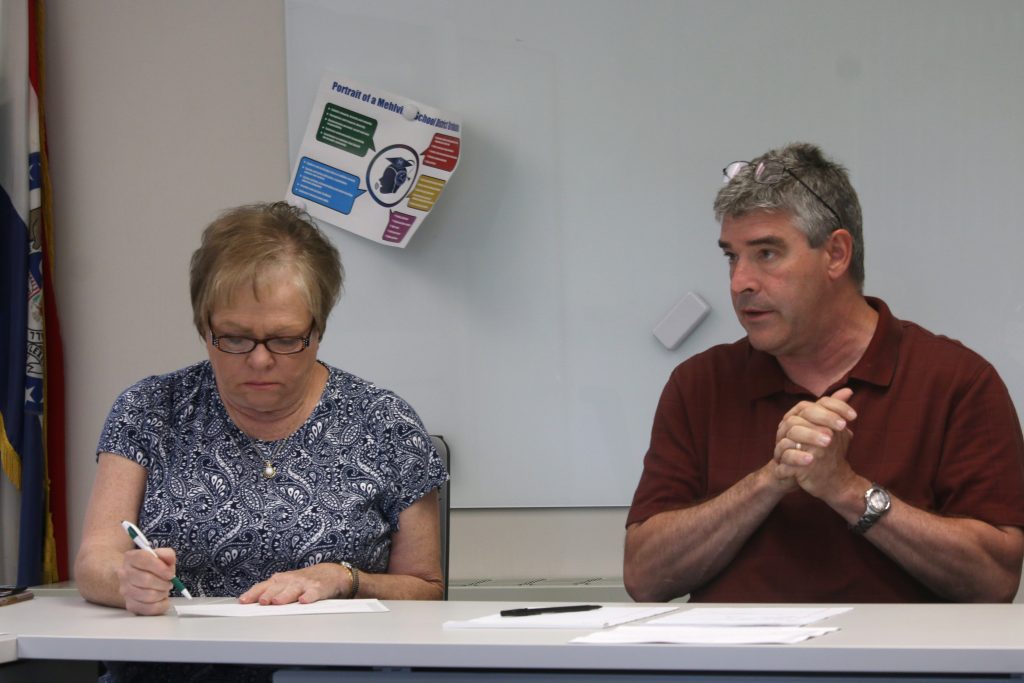

At a Finance Committee meeting last week, Chief Financial Officer Marshall Crutcher and Tom Pisarkiewicz, president of the district’s financial advisor L.J. Hart, said the district will likely receive a “bond premium” on the bond sale in May due to current market conditions and interest rates. A premium bond is a bond that is paid above face value. Instead of $35 million, the district could actually receive up to $38.4 million for the 12-cent bond proceeds because coupon interest rates on bonds — the fixed rates paid on face value — are higher than market interest rates, which change every day. Some bonds pay investors a rate of 2 percent while others may pay 3 percent. To take advantage of interest rates above the market rate, investors pay a “premium” price.

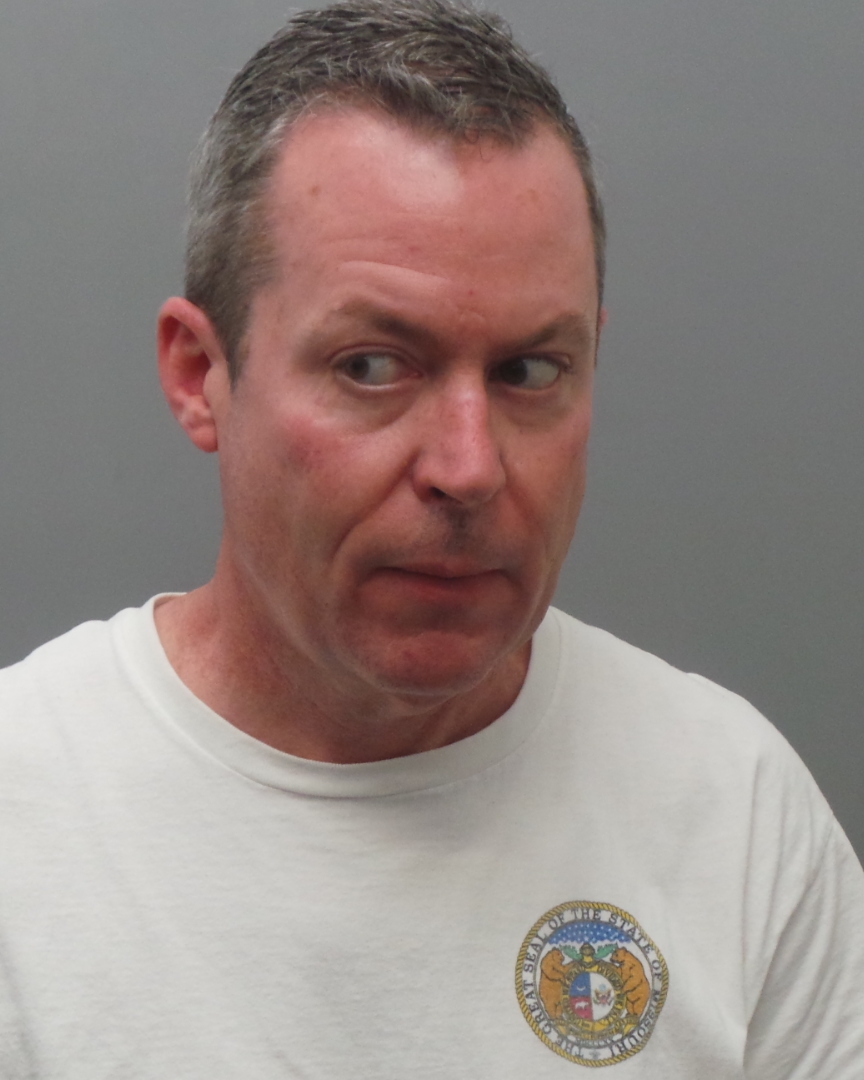

“Investors do this because investors buy the bonds and get interest income every few months. That interest will depend on timing (of the bond sale), but the market rate is well below that,’” said Crutcher to The Call. “Investors want better than market rate. They’re willing to pay par value plus premium so in return they get a higher interest than the market rate.”

While the district could receive $3 million more than anticipated, the premium does not increase the amount of debt the district has to pay off since the premium portion is not considered debt.

“Just because we get $38 million, we’re not paying off $38 million, we’re paying off $35 million,” said Crutcher. “We’re paying off $35 million in principal” with about $11.7 million in interest, so total payout for the bond comes out to around $46 million.

The Facilities Steering Committee, which toured all but one of the district’s facilities over an 18-month period in 2019-2020, identified over $200 million in facilities needs across the district. The committee narrowed the list down to $35 million in priorities.

“All the bond money will go for those originally bond-identified projects, but instead of only doing $35 million, we’re going to do $38 million,” said Crutcher. “It allows us to do more of the projects that were identified.”

The district is opting for the least amount of premium needed to sell the bonds in order to minimize interest expense, rather than trying to maximize the premium by offering high interest coupons.

“What’s important to know is that without the premium … investors just wouldn’t be interested. Current market conditions require it,” said Crutcher. “We would totally sell at par value if we could … so we’re looking at what’s the minimum amount of premium we can get. If we get any more, that will increase interest expenses more.”

Because ballot language for Prop S said that it was a no-tax-rate-increase, the premium cannot be placed in the debt service fund to pay for the debt. That would cause the levy to go from 12 cents to zero, with the 12 cents from Prop S just being levied into the capital fund instead.

“If we take that premium and put it in the debt service fund, we’re not allowed to levy 12 cents because we will already have the money for next year’s debt,” said Crutcher. “Does it make sense to reduce the tax rate by 12 cents when you rank … dead last on debt per student? Does it make sense to reduce revenue? In my book, no.”

The exact coupon interest rate the bond will be sold at sometime in May will depend on whatever is happening in the market on that day, but it is expected to be between 2 and 3 percent. The $38.4 million premium is just an estimate and the exact premium won’t be known until the day L.J. Hart and Pisarkiewicz conduct the bond sale for the district. Revenues are anticipated to be received by June 3.

Having only one bond sale rather than dividing Prop S into two sales to reduce interest makes the premium and interest rates more predictable. Interest rates — which are going up — could increase before a second sale, meaning the premium would be reduced, offsetting any interest savings. Having all the money in the district’s funds at once also allows the district to get started quicker on Prop S projects.