The Mehlville School District is asking voters to approve a bond issue April 6 to fund facilities upgrades around the district, but if voters decline to pass the bond issue, the tax levy will stay the same and the district will use the money for operations.

The district is slated this year to pay off its remaining certificates of participation, or COPs, issued from Proposition P, a 49-cent operational tax-rate increase for facilities that voters approved in 2000.

Proposition S for “Safe Schools, Safe Kids,” a 12-cent, $35 million no-tax-rate-increase bond issue, will fund maintenance and safety upgrades including new secure vestibules at all school entrances, by asking voters to use 12 cents of the 45-cent levy from 2000’s Proposition P as a facility investment. The remaining 33 cents, which the district is not placing up for vote, will go toward operations after the district takes a 12-cent voluntary rollback from the 45 cents, according to Prop S ballot language.

As first reported by The Call in January 2017, at least one attorney by that time had given the district a legal opinion that the Prop P tax — which was approved by voters in 2000 as a temporary tax levy for facilities projected to sunset in 20 years — became permanent when voters approved the Proposition T tax-rate transfer in 2008, which shored up district finances. If voters had not approved Prop T, the leases from Prop P would sunset when the bonds are paid off in 2022.

Since then, the district has received legal opinions from its law firm Shands, Elbert, Gianoulakis & Giljum, along with outside law firm Mickes O’Toole; bond counsel GilmoreBell; and financial adviser L.J. Hart, all of which said that while there has been no legal case on the issue, they do not believe the sunset on Prop P applies anymore since voters reset the tax-rate ceiling with Prop T.

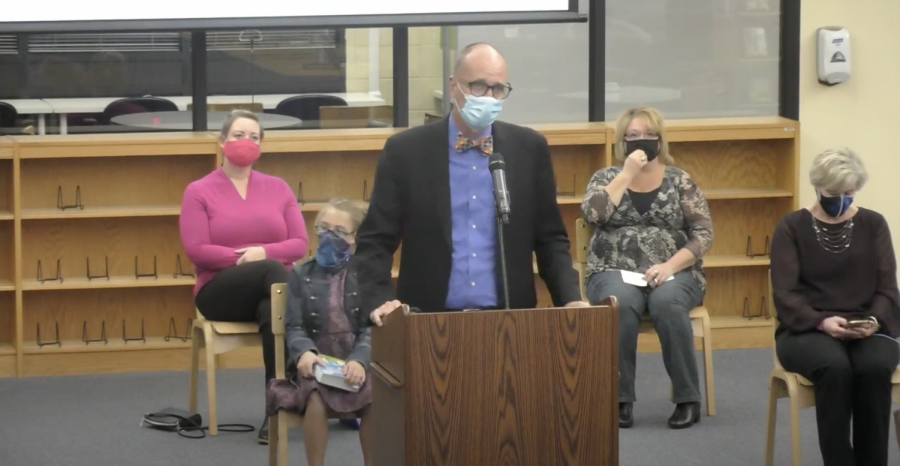

Superintendent Chris Gaines initially said in 2017 that he would not keep Prop P permanent unless voters agreed, but new legal opinions now give him more confidence that voters already approved that tax rate. The district will continue to levy the 45 cents whether or not Prop S passes.

Since Gaines came to the district in 2015, he has often spoken about how Mehlville has historically underinvested in maintaining facilities. Although the district has suffered financially during COVID-19, he said the pandemic had no impact on the decision.

“At this point going to the ballot for anything beyond a bond is just not prudent because we can keep it and continue moving forward,” Gaines said last week, citing the consistent opinions from multiple sources. “I don’t think that was … purposefully with the 2008 vote, but that’s what it was effectively. We’ve just become more confident in that over time.”

Shands Elbert partner Fred Vilbig wrote in a July 26, 2018, legal opinion that Prop T “established a new operating levy ceiling from that point forward regardless of the previous levy termination language,” adding, “Please understand that this position is not unassailable, and some citizens could raise an objection. However, the only truly safe interpretation would be to treat the termination as being still in place and plan accordingly.”

Tom Mickes, a partner in the Mickes O’Toole law firm, wrote July 30, 2018, that the permanent tax rate was also solidified with 2015’s tax-rate increase Proposition R and 2016’s 4-cent tax transfer Proposition A as “voters were informed of the potential adjusted levy and approved the same. It is thus my opinion that the existing levy is valid and can be relied upon in making future decisions on funding issues.”

Neither the district nor voters appeared to be aware that placing the tax levy in the ballot language in Prop T would lead to a permanent tax-rate increase, Gaines noted.

“I don’t think anybody was trying to mislead and I don’t know that anyone would have necessarily thought of or considered all of the side effects of the 2008 vote,” Gaines said. “The 2008 vote was to move some money … but the way the ballot language really is required to be written, there was a side effect to that.”

Gaines told The Call that his opinion on the issue began to change around late 2018 and early 2019.

“We had looked pretty heavily into (it) … the early winter of 2019 was probably when I started shifting my thinking from where it was in 2016/2017 based on the amount of feedback we were getting (from law firms),” said Gaines.

The district reached out to the state auditor’s office and attorney general’s office in the past asking them to weigh in on whether the tax rate reset with Prop T included the Prop P levy in that new tax rate approved by voters, but both offices declined to take a stance.

But the superintendent said Mehlville has not approached the auditor or attorney general in recent years because of the district’s confidence in the many attorneys’ opinions.

“We entertained it, but the advice we had received as well as from some chief financial officers across the state was that we were in good shape,” said Gaines. “The auditors have annually approved our tax rates or signed off on them.”