JEFFERSON CITY — In an attempt to level the playing field for Missouri businesses, all online retailers could soon be required to pay sales taxes in the state.

Three bills attempting to do just that were brought before the Senate Ways and Means Committee in February, each differing on how to address the resulting increase in state revenue.

These bills are collectively known as “Wayfair bills,” a reference to the 2018 U.S. Supreme Court case South Dakota v. Wayfair, which formally allowed state sales taxes to be applied to out-of-state online retailers. Missouri is one of only two states with sales taxes to not also have a “Wayfair tax.”

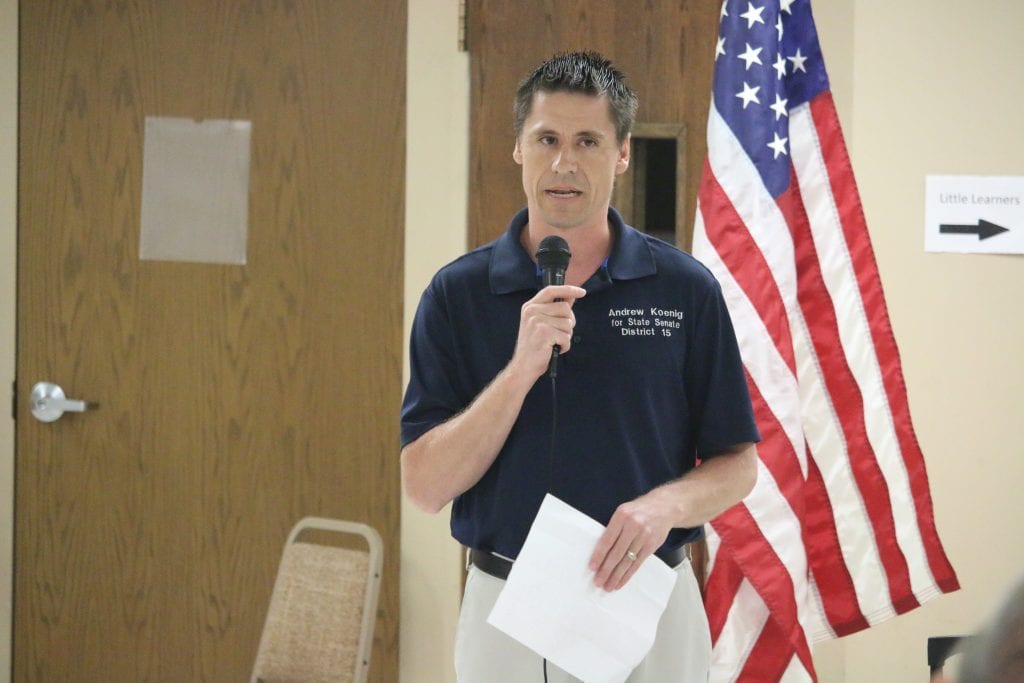

Committee Chairperson Sen. Andrew Koenig, R-Manchester, has been pushing for a Wayfair tax since the 2019 legislative session. Similar bills were again proposed during the 2020 session, which was heavily impacted by the COVID-19 pandemic, but they ultimately failed.

One of the main sticking points, especially for Republicans who control both the House and Senate, has been finding a balance where businesses are all taxed fairly but an increase in revenue does not lead to increased spending.

Koenig’s latest Wayfair bill would lower rates for individual income taxes, something the senator in 2019 called “the most destructive tax known to man.” While this is intended to make the program revenue neutral on its own, if there is any additional revenue, it would go into a new disaster relief fund overseen by the governor’s office.

Koenig said the focus should be kept on making the tax system fair for Missouri businesses rather than increasing the overall amount of taxes collected.

“This is not a question of how much we should be taxed but rather of how we should be taxed,” Koenig said.

Another bill was proposed by Sen. Lauren Arthur, D-Kansas City. Rather than directly lowering income taxes, Arthur’s bill would cancel out increased revenue by putting in place an Earned Income Tax Credit. She said similar credits, which give tax breaks to low- to moderate-income workers, have proven to be the strongest incentive for low-income people to work and would be needed because of the pandemic and subsequent economic fallout.

“In a time when families are under distress, this would provide much needed relief,” Arthur said.

A third bill was proposed by Sen. Denny Hoskins, R-Warrensburg. His bill would decrease the state sales tax over time in order to account for the new revenue coming in from businesses that previously had not been paying.

“My main goal is that our brick-and-mortar stores can compete with online businesses,” Hoskins said.

Multiple witnesses testified in support of all three bills.

“We are neutral on the policy decision of what to do with the money,” said Chuck Pierce, representing the Missouri Society of Certified Public Accountants and the Associated Industries of Missouri. “We ask that that not get in the way of getting Wayfair done.”

Sen. Bob Onder, R-Lake St. Louis, told Pierce he thinks the easiest way to get the tax done is with a simple bill that leaves out things like a tax credit or an elimination of sales taxes for feminine hygiene products, which has also been proposed.

“You mention that they’re neutral with what to do with the money, that’s what this has been hung up on,” Onder said. “Lets keep this as simple as possible and get it done this year.”

One notable point is that increases to revenue may be overestimated because many large online retailers voluntarily pay state sales taxes already.

The Ways and Means Committee also passed a bill on to the full Senate at the same hearing. The bill, another proposed by Koenig, would allow for taxpayers to receive a tax credit if use of their property was limited by local restrictions, including those in place for COVID-19.