A group of Crestwood residents is actively opposing a proposed 45-cent tax-rate increase that voters will consider next week.

The Board of Aldermen voted in November to place the tax-rate increase, called Proposition C, before voters in the April 4 election.

A simple majority is required for approval.

If approved, the tax-rate increase would generate roughly $1.13 million annually for “general municipal purposes, including paying the increased costs associated with operating a local Police Department, operating a local Fire Department, building and facility maintenance, and other city operational needs,” according to the ballot language.

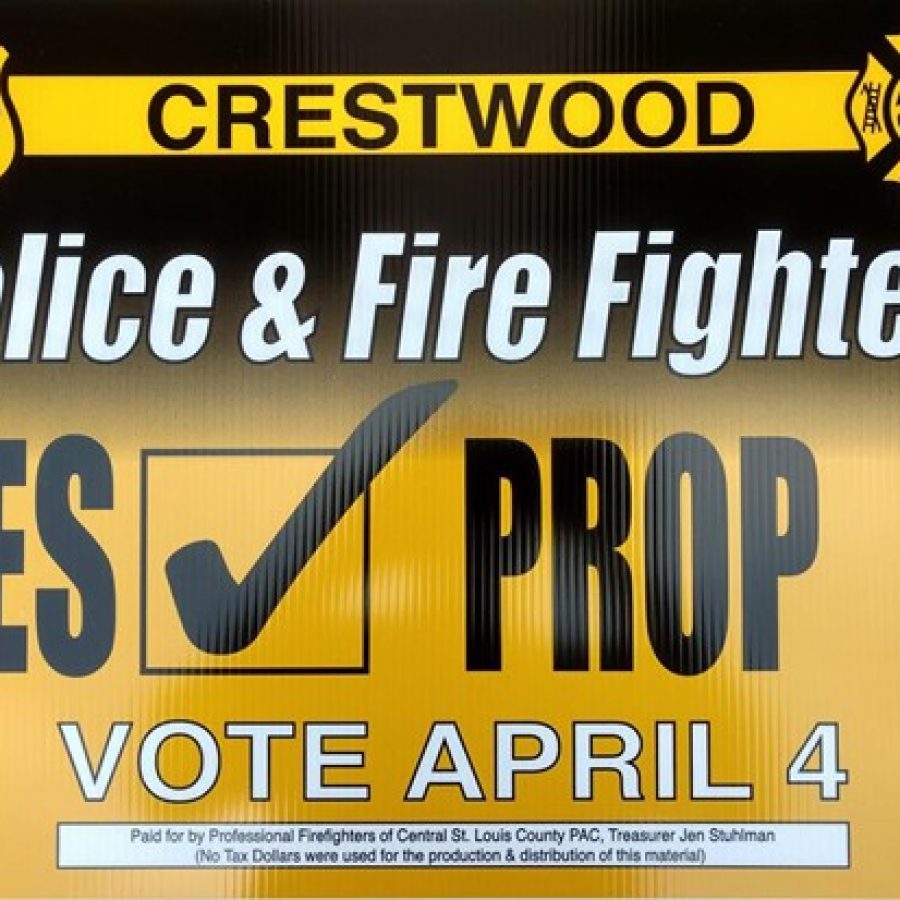

While a group of residents — Crestwood Citizens Against Proposition C — opposes the measure, the Professional Firefighters of Central St. Louis County Political Action Committee is funding yard signs and fliers in support of the tax-rate increase. “Your Police And Firefighters Are Asking For Your Support,” one flier states.

The Professional Firefighters of Central St. Louis County PAC has spent $4,008.32 in support of Prop C, including $3,384 contributed by the Crestwood Professional Firefighters Association.

City officials say passage of Prop C is necessary for the city to continue to provide its current level of services to residents. If the tax-rate increase is not approved, city officials say they will have no choice but to curtail services.

But members of the Crestwood Citizens Against Proposition C, including resident Bill Schelinski, contend the amount of the tax-rate increase is exorbitant and are concerned about the impact on some residents who won’t be able to afford it.

The city’s 2016 tax rates are 27.8 cents per $100 of assessed value for personal property, 24.8 cents per $100 for residential property and 41.4 cents per $100 for commercial property. If Prop C is approved, those rates would increase to 72.8 cents for personal property, 69.8 cents for residential property and 86.4 cents for commercial property.

City Administrator Kris Simpson told those attending a March 15 town meeting at the Community Center that asking voters to approve a tax-rate increase is a last resort for city officials. Roughly 20 people attended the meeting, including city officials.

“… Regardless about how you feel about this issue, this is a critical issue for Crestwood. It’s never easy when you have to ask people to sacrifice more of their hard-earned money. It’s not a position that I enjoy being in. It’s very uncomfortable, and if we hadn’t tried everything that we could to deliver a balanced budget, we wouldn’t be here,” he said. “… On the other hand, we have a level of service that we’ve been providing the residents that I believe is very high, and certainly our residents deserve the best service that we can offer.

“If we unilaterally decided to balance the budget, what it would take would/will impact city services in a way that I believe would be noticeable to residents, and so we’re giving you the opportunity to weigh in on what you want us to do. And the way you’ll weigh in is this April at the ballot.”

Simpson presented a financial forecast that he termed “not good.”

“… We’ve got expenditure growth that is currently over our revenues on an annual basis and not only that, but the expenditure growth is growing year over year faster than revenue growth is growing year over year,” he said, adding that city reserves also are declining. “In 2015, we had about $4.9 million in the bank. By the end of 2016, we were about $4.5 million. At 2017, we’re expecting to end this year with just over $4 million in the bank …”

As a result, Simpson projects a cumulative deficit from 2017 to 2021 of $5.2 million.

But Schelinski told the Call that he believes the amount of the tax-rate increase is excessive. For example, if Prop C is approved, the city’s tax rate for personal property would increase by 162 percent, the tax rate for residential property would increase by 181 percent and the tax rate for commercial property would increase by 109 percent.

“I know a lot of families, especially in my corner of Crestwood in Ward 2, that are living paycheck to paycheck. I’ve got people that have been out of work for a while because of either they got laid off or they were dealing with an illness or a spouse has left or a spouse has died …,” he said, adding that he also is concerned about the impact on elderly residents on a fixed income.

In 2015, the Board of Aldermen adopted a fund-balance policy mandating the city maintain operating reserves of no less than 45 percent. Schelinski contends having that much money in reserves is excessive.

“… That’s like you taking half of your paycheck, sticking it in a drawer and saying, ‘I don’t have money to pay my bills.’ Well, yeah, you do. It’s here. It’s in your drawer over here. Now I understand you don’t want to spend down reserves, but do we need almost 50 percent in reserves?” he said.

Schelinski also contends city officials have failed to rein in spending, citing the 2016 budget that projected a total deficit of nearly $690,000 when adopted in December 2015 and the 2017 budget that projects a total deficit of $730,880, including $524,086 in the general fund.

Mayor Gregg Roby told the Call that if Prop C fails, one service residents potentially could lose is their streetlights.

“If Prop C fails, I can’t see keeping the street lights on because it’s $80,000 we just can’t afford. And you hate to do that, I hate to say it, but when people say ‘no,’ we’re not going to approve this 45-cent tax, I’d much rather cut streetlights than to cut someone’s job,” he said. “It is part of the general fund. Our contract with Ameren is up for renewal, so if we had to do that, we could do it at this time.

“I hate to do it because there’s so many older people who rely on those streetlights for security, but when it comes down to cost and weighing the benefits versus keeping enough firemen or policemen on the streets to patrol our community, I’m going to err on the side of keeping more police and fire on the streets.”

City officials say that for the owner of a $182,000 home, the cost of Prop C will be roughly $13 per year. But longtime resident David Brophy, who opposes Prop C, believes the actual cost to homeowners will be greater because 2017 is a reassessment year. Based on preliminary property values released by the county, Brophy calculates that for the 22 properties on Lodge Drive, where he lives, the increase in assessments ranges from 10.3 percent to 52 percent, with the mean increase 18.9 percent.